INCO-Terms simplified by Vanmovers Logistics Inc. specialists

- randkawa

- Jan 20, 2025

- 5 min read

Mastering Incoterms for International Trade Success

Author: Rand Mustafa, MBA Logistics & Operation design specialist

Introduction to Incoterms

Incoterms, short for International Commercial Terms, are globally recognized rules published by the International Chamber of Commerce (ICC). These terms simplify international trade by clearly defining the roles, responsibilities, costs, and risks between sellers and buyers.

Introduced in 1936, Incoterms have evolved over time to reflect modern trade practices. The most recent update, Incoterms 2020, remains a cornerstone for importers, exporters, and logistics professionals worldwide.

This article breaks down Incoterms in a structured, easy-to-understand format, helping you gain the expertise to use these rules effectively. Why Are Incoterms Important?

Clarify Responsibilities: Incoterms define who handles transportation, insurance, export/import clearance, and delivery.

Reduce Misunderstandings: By setting clear expectations, they prevent costly disputes between trading partners.

Support Legal Agreements: Governments and legal entities recognize Incoterms as a standard for interpreting trade contracts.

How Incoterms Work

Incoterms focus on the logistics of moving goods, but they do not:

Determine ownership or transfer of title.

Define payment terms or remedies for breach of contract.

Cover risks outside the scope of delivery (e.g., storage).

Each Incoterm specifies:

Transfer of Risk: When liability for the goods shifts from seller to buyer.

Cost Responsibilities: Who pays for transportation, insurance, duties, and tariffs.

Delivery Obligations: Where goods are handed over and what is included in the sale price.

The Two Categories of Incoterms

Incoterms are divided into two groups, based on the mode of transport:

1. Rules for Sea and Inland Waterway Transport

Applicable only when goods are shipped via waterways.

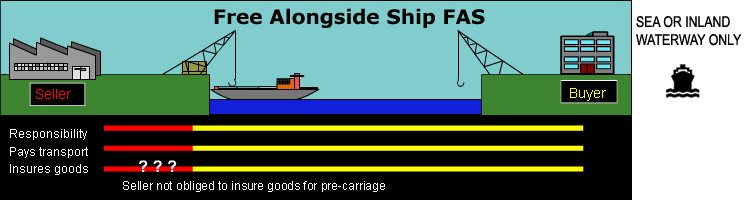

FAS (Free Alongside Ship): The seller delivers goods alongside the vessel. Risk passes to the buyer at this point.

FAS : Free Alongside Ship: Risk passes to buyer, including payment of all transportation and insurance costs, once delivered alongside the ship (realistically at named port terminal) by the seller. The export clearance obligation rests with the seller. FOB (Free On Board): Risk transfers once goods are loaded onto the ship.

FOB: Free On Board: The buyer assumes risk and is responsible for all transportation and insurance expenses; the seller delivers the goods on board the ship. This goes beyond FAS. CFR (Cost and Freight): The seller arranges transport to the destination port, but risk passes once goods are on board.

CIF (Cost, Insurance, and Freight): Similar to CFR but includes insurance coverage arranged by the seller.

2. Rules for Any Mode of Transport

These terms apply to road, rail, air, sea, or a combination of these modes.

EXW (Ex Works): The seller makes goods available at their premises. Buyer handles all transport and risk from this point.

FCA (Free Carrier): The seller delivers goods to the carrier at a named location. Risk passes to the buyer once delivery is completed.

CPT (Carriage Paid To): The seller pays for transport to a named destination, but risk transfers to the buyer earlier.

CIP (Carriage and Insurance Paid To): Similar to CPT, but includes seller-arranged insurance.

DAP (Delivered at Place): The seller delivers goods to the buyer’s specified location, excluding import duties.

DAT (Delivered at Terminal): The seller delivers to a terminal at the destination, unloading included.

DDP (Delivered Duty Paid): The seller assumes full responsibility for delivering goods, including import clearance and duties.

Choosing the Right Incoterm

For Exporters

New to Exporting? Choose EXW for minimal risk.

Offering a Competitive Advantage? Use CIF or CIP to simplify logistics for the buyer.

For Importers

Control Over Logistics? Opt for FOB or FCA to manage shipping costs directly.

All-Inclusive Solution? Choose DDP for a hassle-free experience but higher costs.

Key Changes in Recent Incoterm Revisions

2010 Update:

Replaced outdated terms like DAF, DES, DEQ, and DDU with DAT (Delivered at Terminal) and DAP (Delivered at Place).

Shifted focus to align with modern shipping practices and clarified "on-board" delivery instead of "ship’s rail."

2020 Update:

Increased emphasis on insurance responsibilities in CIP.

Simplified language to enhance understanding globally.

Common Mistakes to Avoid

Failing to Specify the LocationAlways include the exact location with the Incoterm. For example:

Correct: EXW Factory, Toronto

Incorrect: EXW

Assuming an Incoterm Covers EverythingIncoterms do not address payment terms, quality standards, or penalties for delays.

OvercommittingAvoid terms like DDP unless you have the resources to manage import duties and taxes effectively.

Memorization Tips

Group Similar Terms Together

EXW, FCA: Minimal seller responsibility.

CFR, CIF, CPT, CIP: Seller covers transport but risk transfers early.

DAP, DAT, DDP: Seller handles most logistics, with increasing responsibility.

Visualize the Risk TransferPicture the journey of goods and note when risk moves from the seller to the buyer.

Create MnemonicsExample: "Every Farmer Can Cultivate Crops Daily"(EXW, FCA, CPT, CIP, DAP, DAT, DDP).

Practical Applications

Case Study 1: Simplifying Logistics for a BuyerA Canadian exporter uses CIF Vancouver to attract European buyers, handling all logistics and offering peace of mind.

Case Study 2: Cost Control for an ImporterA retailer in Germany prefers FOB Shanghai, allowing them to negotiate better shipping rates with their own freight forwarder.

Conclusion

Mastering Incoterms is crucial for success in international trade. By understanding the roles, responsibilities, and risks involved, you can:

Negotiate better deals.

Reduce misunderstandings.

Build stronger business relationships.

Remember, Incoterms are tools—using them effectively depends on clear communication and a strategic approach to logistics. Start practicing today, and you’ll soon navigate international trade with confidence.

Comments